7 Simple Techniques For Transaction Advisory Services

Wiki Article

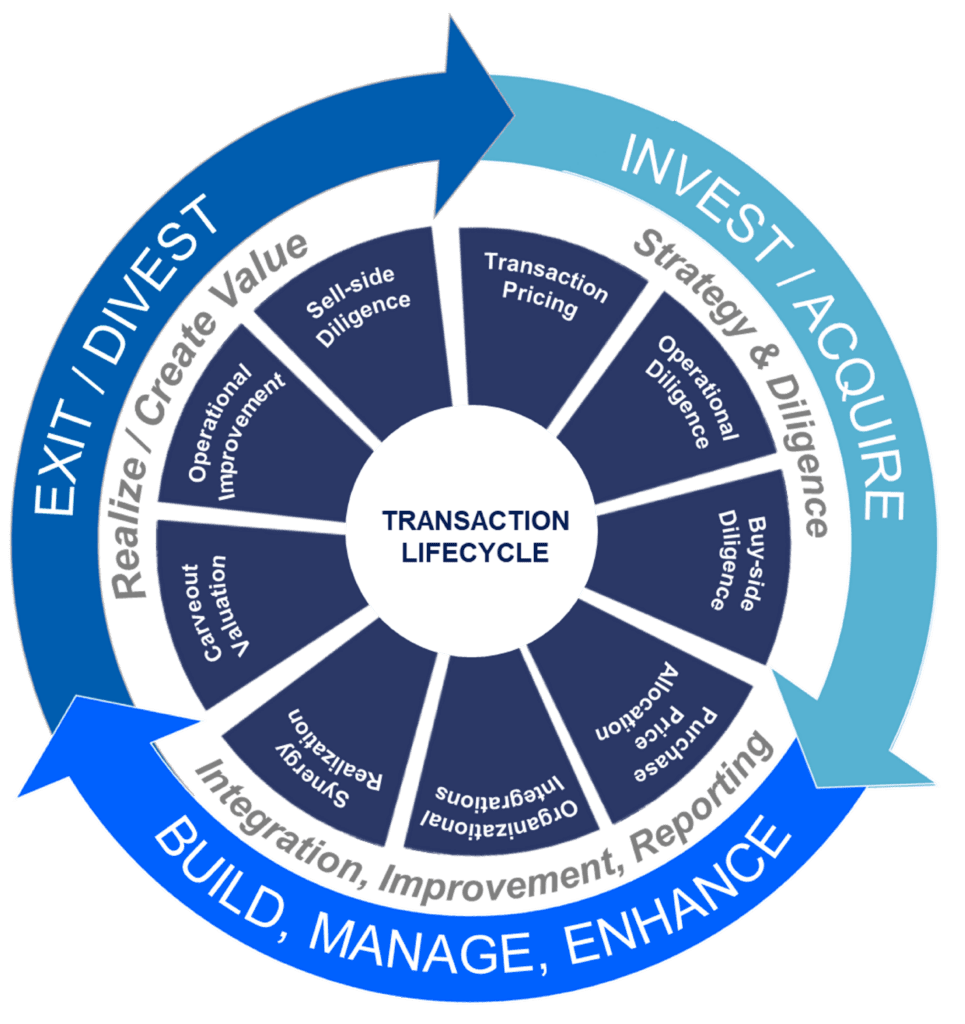

The Main Principles Of Transaction Advisory Services

Table of Contents6 Simple Techniques For Transaction Advisory Services10 Easy Facts About Transaction Advisory Services ShownThe 7-Second Trick For Transaction Advisory ServicesTransaction Advisory Services - The FactsWhat Does Transaction Advisory Services Mean?

This action makes certain business looks its ideal to potential buyers. Getting business's value right is critical for a successful sale. Advisors make use of different approaches, like discounted cash money flow (DCF) analysis, contrasting with similar firms, and recent transactions, to find out the fair market worth. This helps set a reasonable rate and bargain efficiently with future purchasers.Purchase experts action in to help by obtaining all the needed details organized, addressing inquiries from customers, and arranging check outs to business's place. This constructs trust fund with buyers and keeps the sale moving along. Getting the finest terms is crucial. Purchase experts utilize their knowledge to aid entrepreneur take care of challenging arrangements, satisfy purchaser expectations, and framework deals that match the owner's objectives.

Meeting lawful policies is vital in any type of company sale. Transaction advising services work with lawful professionals to create and examine contracts, agreements, and various other lawful documents. This decreases threats and ensures the sale follows the regulation. The function of purchase consultants expands beyond the sale. They assist company owner in preparing for their next actions, whether it's retired life, starting a brand-new endeavor, or managing their newfound wide range.

Deal experts bring a wealth of experience and understanding, making certain that every aspect of the sale is handled expertly. With critical prep work, appraisal, and arrangement, TAS helps local business owner attain the highest possible list price. By ensuring legal and governing conformity and managing due diligence together with various other deal staff member, purchase experts reduce prospective threats and liabilities.

The Only Guide for Transaction Advisory Services

By contrast, Big 4 TS teams: Work with (e.g., when a prospective purchaser is carrying out due persistance, or when an offer is shutting and the purchaser requires to integrate the business and re-value the seller's Balance Sheet). Are with fees that are not linked to the deal closing effectively. Make charges per interaction somewhere in the, which is less than what investment banks earn also on "tiny bargains" (however the collection possibility is likewise much higher).

The interview questions are extremely comparable to financial investment financial meeting inquiries, yet they'll concentrate extra on audit and evaluation and much less on subjects like LBO modeling. Anticipate concerns about what the Change in Working Resources methods, EBIT vs. EBITDA vs. Earnings, and "accountant just" subjects like trial balances and just how to go through events making use of debits and credits instead than monetary statement changes.

Transaction Advisory Services - The Facts

Specialists in the TS/ FDD groups might additionally interview management about whatever above, and they'll compose an in-depth record with their searchings for at the end of the procedure., and the general shape looks like this: The entry-level role, where you do a lot of information and economic evaluation (2 years for a promo from right here). The next level up; comparable job, however you get the more interesting little bits (3 years for a promo).

Particularly, it's challenging to get promoted past the Supervisor level since few people leave the task at that stage, and you require to begin revealing evidence weblink of your capability to generate profits to breakthrough. Allow's start with the hours and lifestyle since those are less complicated to explain:. There are occasional late evenings and weekend break work, however nothing like the frantic nature of financial investment financial.

There are cost-of-living modifications, so expect lower compensation if you're in a cheaper area outside major financial (Transaction Advisory Services). For all settings other than Partner, the base wage comprises the mass of the total payment; the year-end perk could be a max of 30% of your base wage. Commonly, the very best method to raise your earnings is to change to a different firm and work out for a higher income and bonus offer

5 Simple Techniques For Transaction Advisory Services

At this stage, you need to just remain and make a run for a Partner-level function. If you desire to leave, maybe move to a customer and perform their evaluations and due diligence in-house.The major problem is that due to the fact that: You normally need to join one more Big 4 group, such as audit, and job there for a couple of years and after that move into TS, job there for a couple of years and then move right into IB. And there's still no warranty of winning this IB function since it depends on your area, customers, and the employing market at the time.

Longer-term, there is also some risk of and because assessing a company's historical economic details is not precisely rocket science. Yes, click here to find out more humans will certainly always require to be entailed, yet with even more sophisticated technology, reduced headcounts might potentially sustain customer involvements. That claimed, the Purchase Services team beats audit in regards to pay, work, and leave opportunities.

If you liked this short article, you might be interested in analysis.

The 5-Minute Rule for Transaction Advisory Services

Create sophisticated financial frameworks that aid in determining the actual market price of a company. Provide advising job in relationship to company assessment to assist in bargaining and pricing structures. Explain one of the most ideal kind of the offer and the type of consideration to employ (cash money, supply, make out, and others).

Do assimilation special info planning to determine the procedure, system, and business adjustments that may be required after the bargain. Set standards for integrating divisions, innovations, and company procedures.

Recognize prospective decreases by reducing DPO, DIO, and DSO. Examine the potential client base, sector verticals, and sales cycle. Think about the opportunities for both cross-selling and up-selling (Transaction Advisory Services). The operational due diligence supplies vital understandings right into the functioning of the firm to be acquired worrying danger analysis and worth creation. Recognize temporary adjustments to finances, financial institutions, and systems.

Report this wiki page